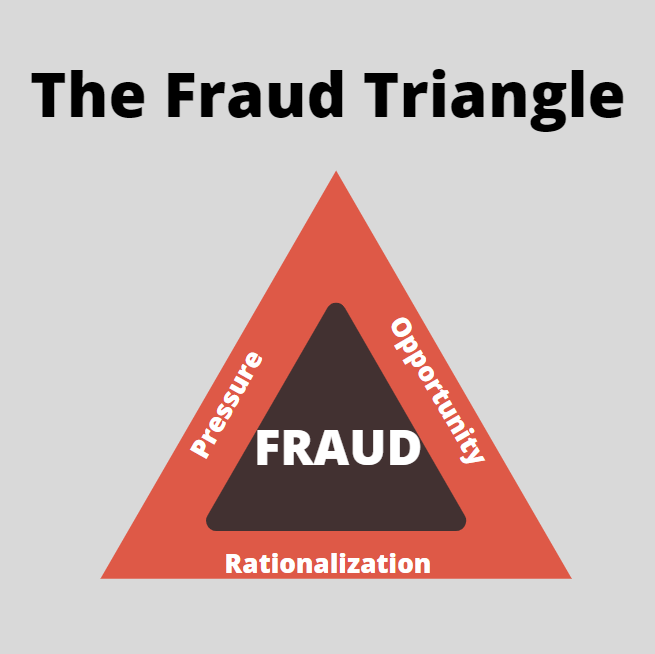

The fraud triangle helps explain the motivation behind why an employee would commit fraud/steal from their workplace. Three components make up the fraud triangle: opportunity, pressure, and rationalization. When all of these components exist, there is a high likelihood that fraud will be committed. Similarly, this can signal that fraud has already occurred or maybe ongoing. Seldom are frauds committed spur of the moment. Typically, they are deliberately planned and executed.

Sides of the fraud triangle:

The fraud triangle consists of three sides:

- Opportunity

- Pressure

- Rationalization

Opportunity

The opportunity provides an individual a way to remove funds or assets from a company or individual. As well as be able to cover up the fraud that has occurred.

Cash is the main target, but assets that can be turned into cash are also valuable, as well as assets that can be used to supplement the fraudsters expenses.

This is the only component of the fraud triangle that the business has control over. The business can control the assets, people, information, and computer systems to limit an employee’s opportunity to commit fraud.

Reasons for an opportunity to occur:

- Lack of internal controls

- Ability to override existing internal controls

- Too much faith that the person will act in good faith

- Poor tone at the top

Pressure:

Pressure is the main cause of people being tempted to steal/commit fraud. Very few people steal for the high it gives them. There is typically a reason behind the action. The individual can feel cornered with personal financial pressure or pressure from superiors and feel that there is no other way out. The situation is pressing and leaves them short on time to figure out another solution.

Reasons for pressure to occur:

- Debts are due that the person doesn’t have cash for

- Supporting other family members

- Medical bills

- Pressures from superiors for a specific outcome

- Pressures from superiors to hit specific metrics/goals

- Unforeseen circumstances

- Expensive habits/hobbies

- Living beyond their means

- Earning less than co-workers or friends

- Human resource-related events:

- bad performance evaluation

- fear of job loss

- cut in hours/pay/or benefits

- being demoted

Rationalization

People who commit fraud rationalize their actions. They explain the situation that made them commit fraud and not how their actions were criminal. The rationalization makes it okay for them to commit fraud and as a result, shows how they are deserving of what they unfairly took.

Reasons for rationalization:

- I deserved a raise, and now I’m getting it.

- The company owes me for all the overtime I’ve put in.

- I’ve dedicated my life to this place/cause and haven’t gotten the recognition that I deserve.

- They cut my salary/benefits. I deserve to have it made up in other ways.

Fraud combination

In short, when two or three of these exist simultaneously, you have a situation that is ripe for fraud. Sometimes the fraud is just a one-time deal. Other times the fraud is perpetuated over months or even years. However, the longer the fraud goes on, the bolder the individual becomes, and the more they can siphon out of the company.

Fraud Losses

According to the Association of Certified Fraud Examiners (ACFE), organizations lose on average 5% of revenue each year due to fraud. Most cases last 14 months before being detected and cause a loss of almost $100,000 annually.

Average Fraud last 14 Months =$116,200 in Lost Revenue

Calculating Potential Yearly Loss according to ACFE

Begin with business revenue before any expenses and times it by 5% to see what the ACFE projects the business is losing each year due to employee theft.

Business Revenue X .05 = Expected Fraud Loss

Prevention of Fraud

Fraud prevention measures (internal controls and segregation of duties) must be put into place and reevaluated at a minimum annually. Utilizing internal controls in your organization will help to prevent/deter fraud from being committed. Further, it will help you to spot where fraud has potentially occurred. Your efforts can help save the business thousands of dollars of potential lost income due to fraud.